30 year mortgage forecast

When considering the 30 year mortgage forecast for 2025, our clients are asking, “Should I sell my property or wait?”

Many of our clients are asking for help navigating the unpredictable market. Should I sell? Should I wait? Will interest rates continue to drop?

While predicting the market is challenging, we have some insights to share with you:

- Good news, mortgage rates have decreased slightly and will likely continue declining softly through 2025. Changes are expected to be slow and slight.

- Will we ever see the “unicorn covid year” interest rate of 3%? Probably never.

- 52% of homeowners say they would be motivated to buy their next home if interest rates dipped below 6%. (Bankrate)

- In 2025, expect a surge to begin from home buyers when the interest rate drops under 6%. Spring will most likely be busy. If you’re considering selling, you may consider getting your home ready to sell before competition increases.

- Your home value will increase slightly or even decrease depending on how many buyers get busy shopping in 2025 in response to lower mortgage rates.

Full Real Estate Market Forecast for 2025

October 2024 Monthly Market Report: A Look Ahead to 2025

Welcome to the October 2024 Monthly Market Report! I’m Brandy Lee with BMovingForward, and I’m excited to share insights into what lies ahead for the housing market in 2025. Whether you’re looking to buy real estate for the first time or a homeowner, understanding these trends is crucial for navigating the current and future market. Today, we’ll break down critical factors like mortgage rates, home sales, and pricing so you can make confident decisions in your buying or selling journey.

Reflecting on the Past, Preparing for the Future

The past few years have presented challenges in the housing market. In 2023 and 2024, rising prices, higher mortgage rates, and low inventory made it difficult for many people to find homes. Here’s the good news: you’ve made it through, and there are reasons for optimism as we look toward 2025. Let’s explore the factors shaping the housing market forecast.

30 Year Mortgage Rates: Easing Towards 2025

One of the most pressing concerns in the housing market is mortgage rates. According to Realtor.com, the economy is expected to stabilize, leading to a soft landing that could drive mortgage rates down through the fall and winter. This trend sets the stage for a more favorable homebuying season in 2025.

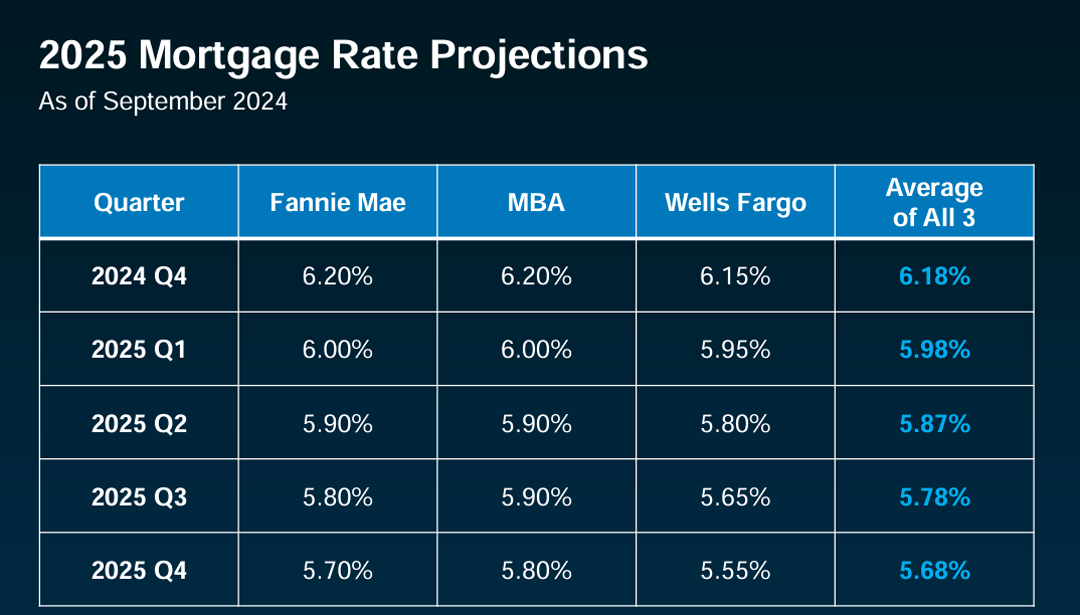

We’re already seeing some easing in mortgage rates, improving affordability for buyers, and helping to bring more inventory into the market. This downward pressure on rates is critical, but it’s important to note that mortgage rates will continue fluctuating as they respond to economic factors like inflation and unemployment. However, experts like Fannie Mae, MBA, and Wells Fargo are predicting rates in the mid-to-high 5% range by 2025, giving buyers greater purchasing power.

The Fed’s Role in Mortgage Rates

There’s often confusion about how the Federal Reserve impacts mortgage rates. While the Fed’s interest rate decisions influence the housing market, it’s not a direct cause-and-effect relationship. Instead, mortgage rates are influenced by inflation and the overall economic climate.

Although the Fed is expected to ease interest rates over the next 6 to 18 months, the transition won’t happen overnight. It will be a gradual process, and while there will be some volatility along the way, the general outlook is positive. As mortgage rates continue to drop, it will improve affordability and pull more buyers off the sidelines.

More Buyers and Sellers: Inventory and Demand in 2025

As mortgage rates decline, demand is expected to increase. Wells Fargo recently stated that lower financing costs could draw many potential buyers back, especially those hesitant about affordability. For example, research shows that on a $500,000 loan, monthly payments have decreased by around $500 compared to last year. That’s a significant change, likely motivating buyers to wait for better conditions.

But it’s not just buyers who will be affected. Over one-third of homeowners said they would be more likely to sell if mortgage rates fell below 6%. This shift could unlock more inventory, which in turn means more transactions. Total home sales are projected to increase from 4.7 million in 2024 to 5.4 million in 2025. While we may not return to the highs of the pre-pandemic market, this uptick signals a recovery that could revitalize the real estate industry.

Home Prices: Modest Growth Ahead

What will this mean for home prices? More buyers combined with limited inventory will likely put upward pressure on prices, though experts forecast more moderate growth. Most projections suggest a 2-4% increase in home prices for 2025, with an average of about 2.5% nationally.

While this is far from the rapid appreciation we saw a few years ago, it’s a healthy and sustainable pace that balances rising demand with the available supply. However, as always, local markets will vary. Some areas may see faster appreciation, while others could experience flat or declining prices.