Inflation Busters

Inflation is not going away anytime soon. The current inflation […]

Inflation is not going away anytime soon. The current inflation rate is at an all time high of 8%. How long will it continue to rise know one knows for sure. There are some financial responses you can put into place to counter inflation. Here are the top 3 ways to fight inflation;

Pay off your mortgage early.

48% of homeowners in the United States are mortgage FREE. 63% of homeowners are retired. This means that 15% of homeowners are retired with a mortgage. This might not mean much to you if you just bought your first home. However, if your retirement is coming up it should wake you up to the fact that your home should be paid off by the time you retire. Believe it or not, there’s an easy way to do this, especially if you start with your very first mortgage.

Painless Way to Pay Off Your Mortgage

Did you know, if you pay $100 to $200 extra toward principle every month you’ll pay off your 30 year mortgage 7 years EARLY? This will save you significant money. Paying an extra $100 per month is something almost everyone can manage if they cut a few other expenses out of their budget.

It’s staggering to realize how much of your money goes to interest on a mortgage. Granted, mortgage money is fairly cheap. However, if you plan your budget wisely you can save a lot of money in the long run.

For example, the average home price in the US is $376,000. Of course, the average home price greatly varies depending upon what area in the United States you live. For instance, the average residential single family home in Franklin, Tennessee is $816,000.

Using these two varying examples, over the course of a 30 year mortgage you would pay $300,000 in interest for the $376,000 home and $609,000 worth of interest for the home in Franklin. That’s $10,000 to $20,000 per year in potential savings.

When Does It Make Sense to Have a Mortgage

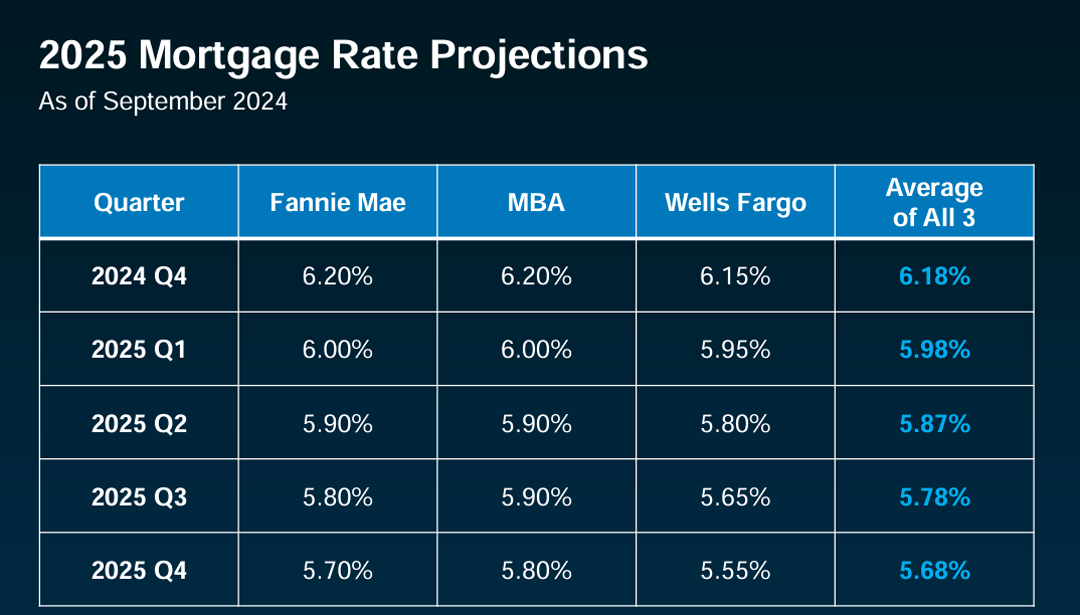

If you need cash flow for investing it makes sense to have a mortgage. The typical stock market return is 6%. If you have a mortgage that’s as high as 5.75%, you’re still making money if your cash is being invested in the stock market or other investment with the same or better return.

Having said that, it wouldn’t hurt most people to pay down your mortgage early. Spending $100 to $200 per month to pay your mortgage off early will help boost your retirement finances. The last thing you when you retire is to have a mortgage you still have to pay on a reduced budget.

Pay off stupid debt.

The average person pays $3,800 in credit card interest per year. Stop throwing $300 per month out the window and get rid of high interest debt.

Work from home.

More then 50% of employees have shifted half of their work time to working remotely from home. This shift is much for acceptable post covid. It saves time and money otherwise spend on fuel. It saves an auto repair and maintenance as well. In response to rising fuel prices, drive less. Save your drive time for the weekend when you deserve a well earned break.