Buy House Now or Wait?

What happens if you decide not to buy a house? [...]

I’m meeting with Bill & Janie who are renting right now. They’re trying to decide whether to buy a house now or wait. We’re going to find out what makes the most sense.

Are you considering buying but unsure if the time is right? We’d love to meet with you to help weigh your unique pros and cons. Schedule your consultation, and we’ll help you develop a game plan that fits your ideal goals.

[eltd_button size=”medium” type=”solid” text=”Schedule Your Consultation” custom_class=”” icon_pack=”font_awesome” fa_icon=”” link=”https://bmovingforward.com/schedule/” target=”_self” color=”ffcc00″ hover_color=”” background_color=”” hover_background_color=”” border_color=”” hover_border_color=”” font_size=”” font_weight=”” margin=””]

To answer this, I’ve got three questions for them;

Question #1: what are they looking for from their next real estate investment?

I want them to look beyond their emotional gain. For example, if they’re a first-time home buyer, all they’re probably thinking about is gaining personal space that they own for a better lifestyle.

My question is, what do they want to do with the property next? For example, do they want the ability to roll equity into a bigger and better house later? Would they consider making it a future rental? Do they want to buy big now to downsize later and pull out some cash from equity to help with their retirement? Would they consider becoming a lender for their adult children to help them get a first-time home?

Question #2: how long do they plan to hold onto this property?

Fix and flip? 2 years reside and then rent? Live and appreciate? Roll up. Roll down?

Question #3: what are their long-term real estate investing goals?

This question should be asked first, but it usually takes a lot of discussion to get to it.

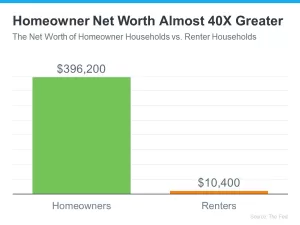

After discussing these questions, they decide to buy instead of rent. They like the idea of accruing appreciated value over time that can be leveraged into another investment. They realize the out-of-pocket expense of a house could be higher than renting, but the maintenance expense is typically much lower than the gained home value.

My top 3 next steps for them are:

#1 Clearly define their long-term real estate goal.

#2 Decide on a property type and budget that fits that goal.

#3 Position their finances to get the property.

Top three reasons to buy a house now instead of rent

Anticipated Price Increase

Buying now is advantageous due to the expectation of a continuous rise in house prices, estimating an annual 7-8% increase. This is based on the current housing market’s shortage compared to the demand for homes, indicating potential financial benefits in purchasing sooner rather than later.

Interest Rate Uncertainty

Future interest rates are uncertain. You might not want to hold your breath waiting for rates to decrease, as there’s no guarantee they will. When you secure a property now, you can consider refinancing later if rates decrease. Housing prices are relatively stable compared to the fluctuation of interest rates.

Personal Circumstances

Real estate can often meet the needs of your life situation. The space you and your family live in can be a huge positive in helping with lifestyle requirements. This is a value that isn’t always accounted for appropriately on paper.

Rent vs. Buy Case Study

Rent vs. Buy Case Study

Bill and Janie have a monthly rent of $2800. They want to buy a first-time home for $750,000 at 7% interest, $2600 annual taxes, $100 monthly HOA, and $3000 annual maintenance cost. They will assume a conservative 8% yearly appreciation value increase for their home.

Buy vs. Rent Comparison:

Cost of Renting: $33,600 per year

Equity Gain of Renting: $0

Cost of Buying: $59,428 per year

Expected Equity Gain of Buying: $60,000 per year

Here’s the math:

Total Cost of Buying=Monthly Mortgage Payment+Property Tax+HOA Fee+Maintenance Costs = $59,428

Monthly mortgage payment = $4,994 \times 12 + $2,600 + $1,200 + $3,000

The annual appreciation on the home would be $60,000.

Renting appears to be a more cost-effective option. However, this doesn’t consider potential returns from home equity or tax benefits associated with homeownership.

After going over the math Bill and Janie decided it’s time to buy. They like the possibility of gaining equity to help build wealth. They love the leverage being homeowners gives them to pursue other investments they’re interested in.

Now that Bill and Janie have decided they want to buy a house now instead of wait, they must first decide what type of real estate they want to buy. Here are some of their choices.

Real Estate Investments with the Highest Return

The type of real estate investment that yields the highest return varies based on location, market conditions, and individual preferences. Here are some common types of real estate investments and their potential for high returns:

Residential Real Estate

Single-Family Homes: These are traditional residential properties. Returns can come from property appreciation and rental income.

Multi-Family Homes (Apartments): Owning apartment complexes can provide rental income from multiple units, potentially increasing overall returns.

Commercial Real Estate

Office Buildings: Investing in office spaces in prime locations can yield high returns, especially in thriving business districts.

Retail Properties: High-traffic retail locations can generate income through leases with businesses.

Industrial Real Estate

Warehouses and Distribution Centers: With the growth of e-commerce, investing in industrial properties for logistics and distribution purposes can be lucrative.

Real Estate Investment Trusts (REITs)

Publicly Traded REITs: These are traded on stock exchanges, allowing investors to buy shares in a diversified real estate portfolio.

Private REITs: These are similar to publicly traded REITs but are not traded on stock exchanges. They may offer higher returns but usually involve higher risk and less liquidity.

Real Estate Crowdfunding

Platforms that allow individuals to pool their funds to invest in larger real estate projects. This can provide access to diverse investment opportunities.

Fix and Flip Properties

Purchasing distressed properties, renovating them, and selling them at a higher price. This strategy requires real estate expertise and market knowledge.

Short-Term Rentals

Renting out properties on platforms like Airbnb for short durations can generate higher rental income than traditional long-term leases.

Land Investments

Buying undeveloped land in strategic locations with the expectation of appreciation over time or potential development.

It’s important to note that the highest return comes with higher risk. Different strategies may suit investors based on risk tolerance, expertise, and financial goals. Conducting thorough research, understanding the local real estate market, and seeking professional advice are crucial steps before making real estate investment decisions.