Election Year Real Estate

Election Year Real Estate Top 3 ways an election year [...]

Election Year Real Estate

Top 3 ways an election year affects real estate.

Top 3 ways an election year affects real estate.

1. November home sales will be slow. Enjoy time with family and friends this Thanksgiving!

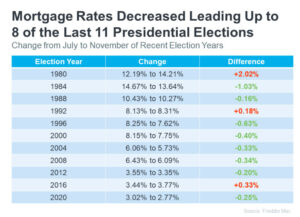

2. Mortgage rates will most likely decrease before the election. October and November could be a great month to buy.

3. Home sales typically go up after an election. Early 2025 may be the best time to make your move.

We can be thankful as we vote to own real estate in the United States. The founders of this nation made sure to include that privilege and freedom as recorded in our Declaration of Independence: No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

There are 169 countries with an International Property Rights Index (IPRI) under 95. The IPRI scores the underlining institutions of a strong property rights regime: the legal and political environment, physical property rights, and intellectual property rights.

Economic conditions, interest rates, and political events influence the real estate market. Election years often introduce uncertainty, impacting real estate trends in various ways. Here’s an overview of historical trends in the real estate market during election years:

Market Uncertainty and Buyer/Seller Behavior

Reduced Activity: Both buyers and sellers tend to be more cautious in the lead-up to an election, often waiting to see the outcome before making significant financial decisions. This can lead to a slowdown in market activity.

Price Stabilization: Due to the reduced activity, home prices might stabilize or experience slower growth during election years.

Economic Policies and Interest Rates

Policy Impact: The real estate market is sensitive to changes in economic policies, such as tax reforms, housing subsidies, and regulations. Elections can bring about potential policy changes that affect the market.

Interest Rates: Central banks may hold off on changing interest rates during an election period to avoid appearing politically motivated. Stable interest rates can maintain housing affordability and buyer confidence.

Historical Data and Trends

The impact can vary significantly by region, depending on local economic conditions and the political climate of each area.

Consumer Confidence

Elections can influence consumer confidence, affecting the real estate market. Higher uncertainty can lower confidence, leading to fewer transactions and slower price growth.

If the market perceives the outcome of an election positively, there might be a surge in activity as pent-up demand is released.

Investment Activity

Real estate investors may adopt a wait-and-see approach during election years. However, some may take advantage of lower competition to make strategic purchases.

Election Year Real Estate in Recent U.S. Elections

2008 Election: Barack Obama. The real estate market experienced a heavy financial crisis.

2012 Election: Barack Obama. Real estate trends during this period showed gradual price increases and a slow return of buyer confidence.

2016 Election: Donald Trump. The Trump administration brought deregulation and tax cuts, which helped to boost real estate investments. The market remained stable with regional variations.

2020 Election: Joe Biden. Pandemic Volatility

The COVID-19 pandemic in early 2020 caused significant disruptions in the real estate market. Lockdowns and social distancing measures temporarily halted real estate transactions. Remote work became widespread, increasing demand for larger homes and properties in suburban and rural areas as people sought more space and home offices.

The Federal Reserve slashed interest rates to near-zero levels to support the economy, making borrowing cheaper. This led to a surge in mortgage refinancing and home buying, as low rates made homes more affordable.

Despite economic uncertainty, housing prices rose sharply due to low inventory, high demand, and historically low interest rates.

2024: Leading Up to Election

Interest rates remain elevated compared to the pandemic lows, impacting affordability for many homebuyers and keeping home price growth in check. Housing affordability remained critical, particularly for first-time buyers and low- to moderate-income households.

The lasting effects of the pandemic-induced remote work trend continue to influence buyer preferences, with ongoing demand for homes with dedicated workspaces and properties in less densely populated areas.

The market outlook 2024 and beyond includes expectations of moderate price growth, continued inventory challenges, and potential policy interventions to address housing affordability.