[vc_row row_type=”row” content_width=”full-width” anchor=”” content_aligment=”left” css_animation=””][vc_column][eltd_section_title animate=”yes” title=”Home, Neighborhood, Market Report” subtitle=”Deep Insight”][vc_column_text]

[/vc_column_text][vc_column_text]

Our complimentary, robust home value estimate report is the BEST data for your wealth-building strategy. It offers a ton of tips on how best to BUILD and leverage your WEALTH.

[/vc_column_text][vc_column_text]

Your home value report includes the following;

RVM – This is your home value closest to what lenders would appraise your home for.

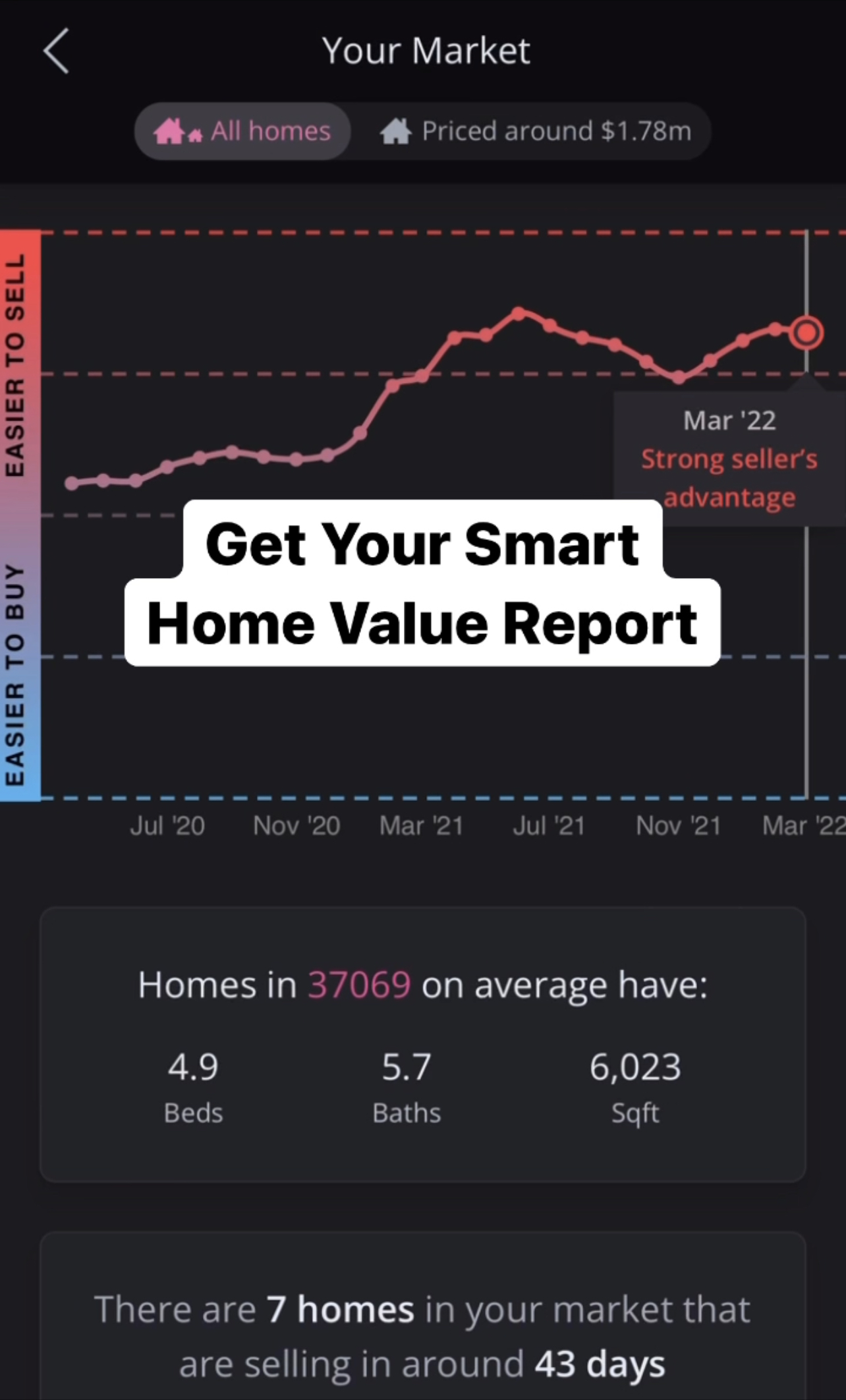

Home value history – get a clear visual of your home’s value in the market over the past several years.

Neighborhood inside information – find out if your zip code is in demand or cooling down.

Your property’s net worth – see how much you could cash this asset out if you decide to sell.

Find out;

- What it would take to buy a second home.

- The equity you could leverage to buy an investment property.

- The amount you could invest if you converted your current home into a rental property and bought another primary residence.

- Your cash-out value right now.

And so much more! What are you waiting for? Sign up today and be in the know about your home’s value and the options that are available to you.

Bonus Information Included in Your Home Value Report

- How much equity do you have available to shift into an emergency fund?

- Amount of equity you have available to apply to home improvements.

- Information to help you decide if you should increase your living space. Adding square footage to your home is the number one way to increase your value.

- Home value amount you could safely pull out to pay off student loans.

- The amount you have available to pay off credit card debt without changing your monthly mortgage payment.

- The equity you could leverage over to purchase solar panels. This energy-efficient home improvement would give you 10% back on your next year’s taxes. It would also help eliminate your monthly electric bill.

- The amount you could pull out to go on a vacation. Maybe you never took a “real” honeymoon? If this is something you’ve always wanted to do but never felt financially able to, now might be the time to “invest” in this life event.

- The amount you may want to consider leveraging over into investments that might give you a greater return than your home value annual increase.

[/vc_column_text][/vc_column][/vc_row]