Tax Credits

3 Tax Benefits for Homeowners Are you trying to figure [...]

3 Tax Benefits for Homeowners

Are you trying to figure out how to maximize your tax credits from home ownership? Here are the top 3 ways to leverage your homeownership into tax credits and deductions.

1 – Mortage Interest

The housing market has experienced a significant slowdown recently due to increased mortgage rates. Tax time will remind many new homeowners that they will benefit from the interest they pay on their homes. The interest is a direct deduction on your tax return. This means all the money you spend on your mortgage interest comes back to you as a tax deduction. This is especially beneficial to entrepreneurs, business owners, and sole proprietors.

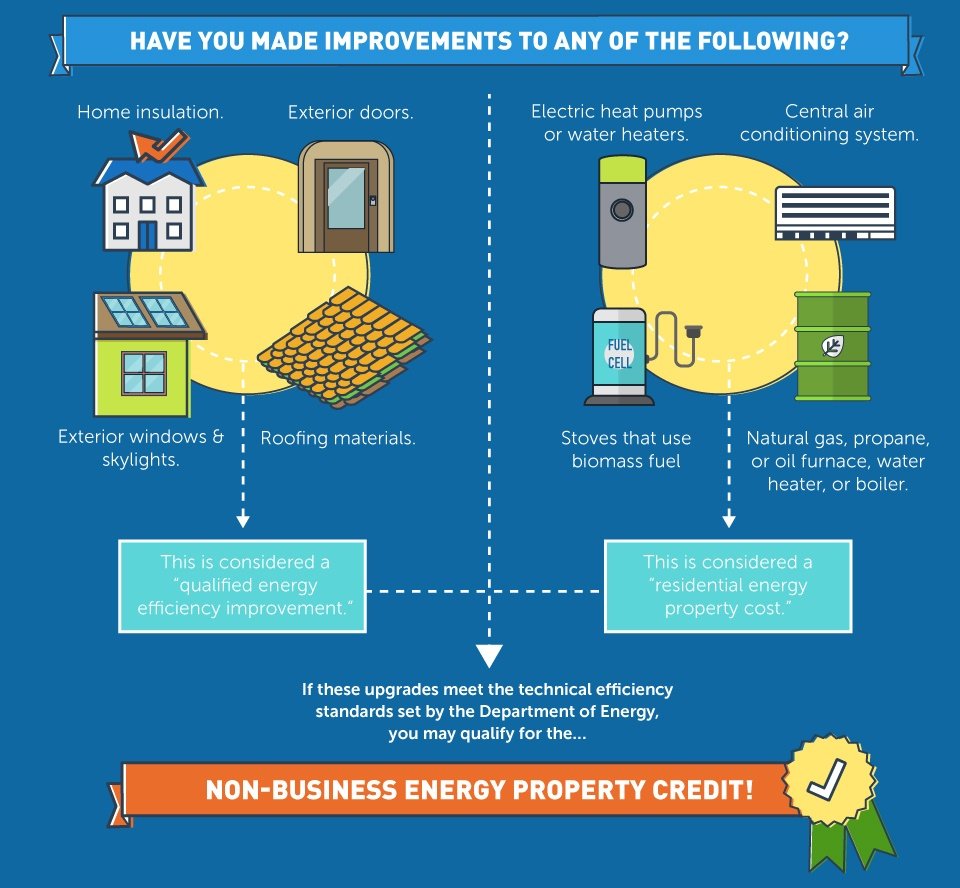

2 – Home Improvement Energy Credit

Homeowners can deduct energy-efficient home improvement costs from their taxes. This includes items such as solar panels and solar water heaters.

3 – Capital Gains Exemption

Homeowners build an investment from their homes in the form of equity. This can be used to purchase additional assets, improve the property, buy additional properties or buy a new property to move to. The Capital Gains Exemption can be applied if the primary residence is sold to buy a different home.

Capital gains tax occurs when selling personal and investment real estate property if there is a gain on the sale. You are taxed on the profit you gain from the sale if you sell the item for more than you bought it. The IRS form to file for capital gains is Schedule D.

Your residence is exempted from the capital gains tax under Section 121 of the tax code. If the following criteria are met, you can exclude up to $500,000 of your gain if you are married and filing jointly and up to $250,000 if you are filing singly.

- The taxpayer must use the property as a principal residence for two out of the last five years before the sale.

- The use as a principal residence does not need to be in concurrent months.

- The §121 exclusion is only available once every two years.

- Second homes and vacation homes do not qualify for §121 tax exclusion.

More about the Capital Gains Exemption >